YieldNest began as a pioneer in restaking but quickly evolved into something bigger, a rapidly growing protocol with the most innovative yield strategies in DeFi & RWA. From MAX LRTs to AI-powered yield aggregation, we’ve always found a way to deliver maximum value for our community.

Our long-anticipated Token Generation Event (TGE) is approaching. And that’s why we are proud to introduce YND, our governance and utility token.

We designed YND to be the way into YieldNest’s governance, growth, and the possibility to earn massive rewards. By staking YND for veYND, you’ll earn a share of our protocol revenue, gain voting power, and unlock boosted rewards. Looking for flexibility? Use the Stake DAO Liquid Locker to get sdYND and stay liquid while still earning.

Whether you’re here to speculate, earn, or shape the future, now is the time to get involved. The earlier and the more you stake, the more you will be rewarded.

Let’s dive into the tokenomics & utilities!

Token Overview

- Token Name: YieldNest DAO Token

- Ticker: YND

- Total amount of YND Tokens: 1,000,000,000

- Type: Utility & Governance

- Blockchain: Ethereum, BNB, INK (more to announce)

YieldNest’s Success in Numbers

$500M+ Total Value Locked (TVL)

$500M+ Total Value Locked (TVL) $60M+ Locked across DeFi protocols

$60M+ Locked across DeFi protocols 10k+ App users

10k+ App users 175K+ Total Social Community

175K+ Total Social Community 20+ DeFi integrations

20+ DeFi integrations 7 Active LRT strategies (including 2 live MAX LRTs, 2 more soon)

7 Active LRT strategies (including 2 live MAX LRTs, 2 more soon) 10–15% Base APY, reaching up to 150%+ APY with DeFi strategies

10–15% Base APY, reaching up to 150%+ APY with DeFi strategies Over 340M+ Seeds distributed across 3 Seasons

Over 340M+ Seeds distributed across 3 Seasons 1800%+ Community Growth in the past year

1800%+ Community Growth in the past year 12+ Smart Contracts audited in the past year

12+ Smart Contracts audited in the past year Future protocol revenue will be used to buy back and distribute YND

Future protocol revenue will be used to buy back and distribute YND

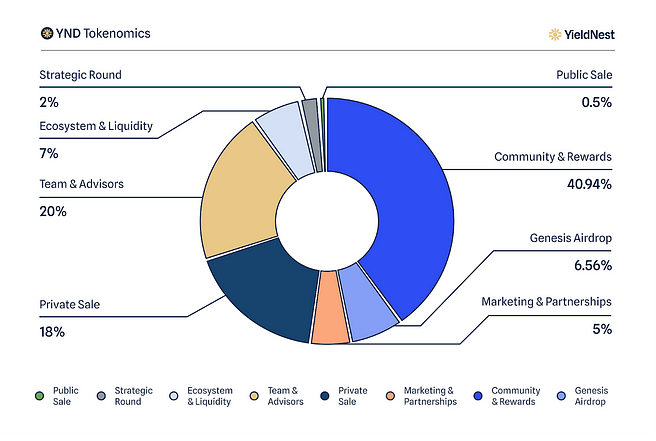

YND Token Supply & Distribution

Total Token Supply: 1,000,000,000 YND

YieldNest prioritizes transparency, fairness, and long-term alignment between stakeholders, partners, and the community. Our focus is on rewarding the most loyal and active users and making sure it’s a fair distribution. The token distribution is structured as follows:

Community & Rewards — 40.94%

- Dedicated to DeFi Partnerships, future Airdrops, potential future Seeds Seasons, Pioneer NFT Program, Programmatic Incentives, and other Community Incentives.

- Encourages active participation and long-term growth.

- Lock-up: vesting linearly for 84 months (7 years)

Genesis Airdrop — 6.56%

- Allocated to users and partners eligible through our Seeds Loyalty Program.

Private Sale — 18%

- Allocated to completed strategic contributors and partners.

- Lock-up: Unlocked at TGE based on prior completed 12-month vesting cycle.

Strategic Round — 2%

- Allocated to newly entered and future strategic contributors and partners.

- Lock-up: vesting linearly for 36 months (3 years).

Team and Advisors — 20%

- Reserved for the core team and advisors who will contribute to YieldNest’s long-term success.

- Cliff: 1 year

- Lock-up: vesting linearly for 36 months (3 years) thereafter.

Marketing & Partnerships 5%

- Allocated to launchpools and other partner & marketing initiatives.

Ecosystem & Liquidity — 7%

- Allocated to support ecosystem initiatives and on-chain liquidity partners to expand the reach and adoption of YND.

- Used for initial liquidity, market makers & treasury management

- Will be converted to POL and handed over to governance.

Public Sale — 0.5%

- Allocated to IDO platforms that supported YieldsNest early on.

Generating More Rewards for Everyone

Programmatic Incentives

YieldNest’s Programmatic Incentives will enable ongoing rewards for eligible stakers and DeFi participants. This could, for example, be used for liquidity pools, gauges, and much more. The distribution logic and eligibility criteria will evolve to match the ecosystem’s needs, driving meaningful engagement with protocol features.

Buyback Program

YieldNest is committed to building sustainable value for our community. We’re excited to announce that we have future plans to dedicate protocol revenue to a strategic token buyback program, reinforcing the value of YND tokens and directly rewarding our supporters. We will continuously buy back $YND and distribute it, expanding and innovating with additional buyback strategies as our ecosystem grows.

Read more about how YieldNest will generate fees.

So… What does this mean?

- More Protocol Activity → More Protocol Revenue: More staking/delegation due to Programmatic Incentives increases YieldNest’s usage, generating more protocol revenue.

- More Protocol Revenue → More Buybacks: With our protocol earnings, we buy back YND, which supports the token price positively.

- More Buybacks → Starting the YND/veYND Flywheel: Buying back YND increases demand. Everyone will be extra rewarded to stake YND to receive veYND for more boosted rewards/governance.

Airdrop Eligibility

Seeds Seasons

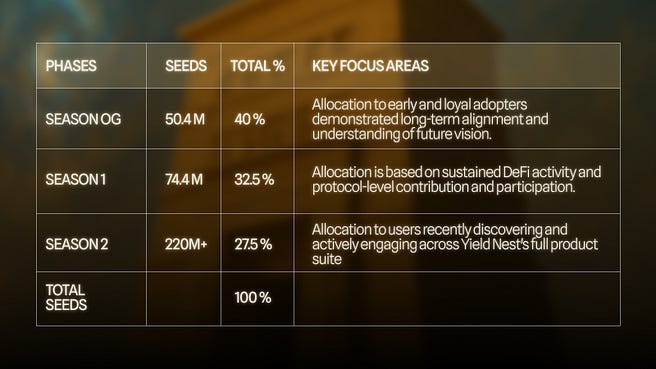

If you’ve earned Seeds through YieldNest’s Loyalty Program, you qualify. You gain Seeds by restaking assets in our products or joining DeFi integrations. Three key Seasons matter:

- Season OG — Epoch 1+2, Early Supporters

- Season 1 Participants — Aug 20 — Oct 22, 2024

- Season 2 Participants — Post-Oct 22 — Snapshot Date

Below is the seed distribution across seasons, designed to ensure fair allocation while prioritizing the most loyal and actively engaged users.

Partners

YieldNest’s thriving DeFi ecosystem is built alongside powerful partners, each bringing unique value and expanding our capabilities across chains, strategies, and security. Below, you can find the eligible partners.

- Llama NFT

- StakeDAO

- Curve

- Yearn

- Convex

- Spectra

- Thena

- Leviathan News

- Nest AI

- PrimeStaked (via Origin Protocol)

- Kernel

- BitGet

- Gate.io

- Zerion

Read more about the Seeds Seasons & DeFi Partners eligibility

YND Token Utility

YND empowers a diverse set of utilities designed to create ongoing demand and long-term holder value.

Core Utilities:

- Governance: Shape the future of YieldNest by voting on protocol improvements, new integrations, and critical DAO decisions.

- Staking (veYND): Stake your YND for veYND, and earn more rewards, future revenue sharing, and boosted governance voting power.

- Rewards & Incentives: Actively earn additional YND through liquidity pools, yield farming, and dedicated community events.

- Delegated Governance via Liquid Lockers (via sdYND with StakeDAO): Delegate your governance power and compound your rewards.

Deep Dive: Governance Utilities

The YieldNest DAO leverages a hybrid governance model combining human oversight and AI-driven analytics (Aragon V2 & Nest AI). This ensures transparent and efficient decision-making, empowering the community to actively shape the protocol’s evolution without friction. That’s the vision behind YieldNest, and at the heart of it all is veYND — the key to taking part in meaningful governance, receiving a portion of protocol revenue, growing your rewards, and unlocking new opportunities.

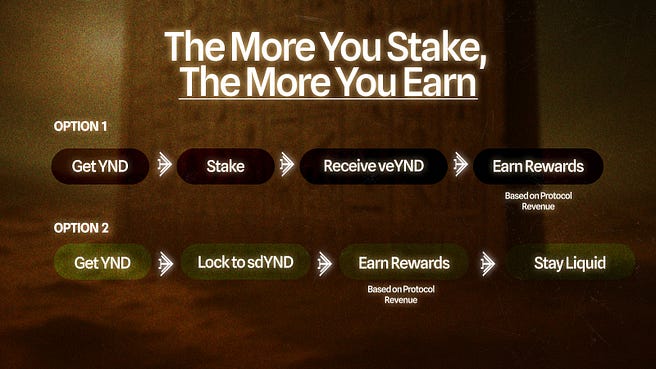

The more you stake, the more you earn…

How it works (simple as it gets)

Get YND → Stake → Receive veYND → Earn Rewards (Protocol Revenue)

OR

Get YND → Lock to sdYND → Earn Rewards (Protocol Revenue) & Stay Liquid

Stake YND to receive veYND:

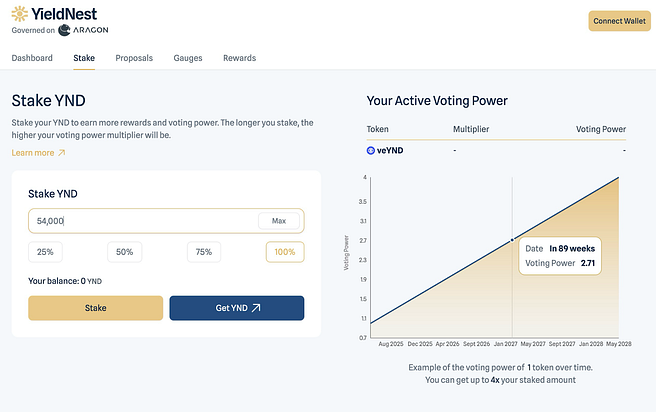

When you hold YND tokens, you’re essentially owning a piece of YieldNest. But to truly start earning more and steer the protocol’s direction, you can stake YND to receive veYND. The more YND you stake and the longer you lock it up, the more rewards and voting power you gain.

Think of veYND as your voice within the YieldNest ecosystem: it grants you voting power on everything from gauges, integrations & DeFi strategies. This ensures that those who believe in the protocol’s long-term success also hold the most decision-making power.

In short:

- Users stake YND to receive veYND.

- Voting power builds up linearly over time while YND remains staked and reaches its maximum value in 36 months after staking.

- Rewards will become claimable as YND.

- Unstaking YND resets voting power, encouraging long-term commitment without locking users in.

- The cooldown period to unstake veYND and get YND back is 30 days.

Key advantages

- veYND gives YND stakers more rewards and earnings

- A flexible, user-driven governance model evolves with the community’s and protocol needs.

- Rewarding our active and invested community.

- Governance participation doesn’t require giving up control of assets.

- The system rewards grow consistently over time.

How can you use your voting power?

- Programmatic Incentives — Possibly the most tangible aspect of governance for many DeFi power users: You can vote on how YND incentives get distributed across various liquidity pools, gauges and DeFi strategies.

- Fee Distribution — Every product or DeFi integration generates fees. veYND holders potentially could collectively decide how much goes back to the Treasury, subDAOs, or direct buyback-and-distribute models.

- Integrations & Products — A new cross-chain partnership? A promising yield aggregator to blend into an existing MAX LRT strategy? You, as a veYND holder, help to decide the direction.

- SubDAOs — As YieldNest grows, new initiatives could be branched off into subDAOs. While these subDAOs manage their own treasuries, over-arching decisions will still flow through the main governance structure. Via veYND, it ensures your voice echoes and weighs in.

With veYND, in the future, you will be able to start earning a piece of our protocol revenue, and your voice will have a real impact, right down to influencing the APY you and others can earn. We use a buyback-and-distribute model for fees, aligning financial incentives with ecosystem growth.

Delegate YND to StakeDAO to receive sdYND

As an alternative, we are also offering a Liquid Locker via StakeDAO, where you can delegate to stake YND and receive sdYND — a tradable version of veYND. With sdYND, you also earn future protocol rewards, just like veYND holders, but without locking up your assets. It’s ideal for those who want to stay flexible, speculate, or use their tokens elsewhere in DeFi while still benefiting from YieldNest’s growth.

Read more about our governance.

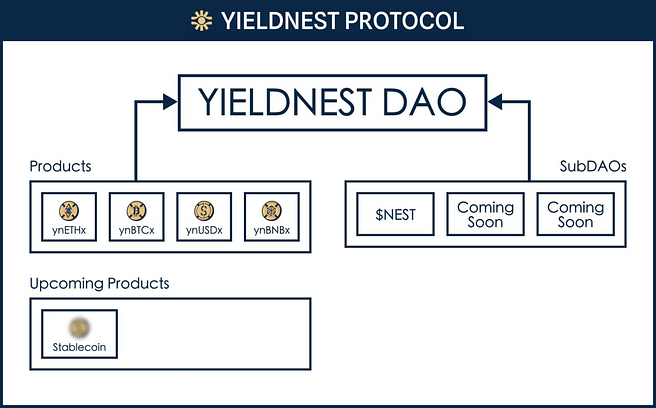

YieldNest SubDAO Structure

Over time, YieldNest products (such as MAX LRTs) might spin into subDAOs with their treasuries. They can operate with a degree of independence, making day-to-day decisions without requiring a main governance vote for every move. However, larger strategic shifts or budget proposals typically loop back to veYND holders for approval. With this, subDAOs enjoy independence for smaller tasks while the broader community still upholds an overarching decision-making power.

Example: SubDAO — NEST AI

Nest AI is YieldNest’s first subDAO — an autonomous AI agent dedicated to market analysis and yield optimization. It continuously scans on-chain data to propose new strategies, recommend liquidity incentives, or even identify new opportunities for future subDAOs. While Nest AI operates independently for tactical decisions, any major shifts or budget allocations are routed back to veYND holders for final approval. This setup combines AI-driven innovation with community oversight, ensuring both speed and accountability.

Read more about our SubDAO structure.

YieldNest Ecosystem Statistics

YieldNest’s ecosystem growth is exponential:

Backed by 14 prominent contributors

Backed by 14 prominent contributors Expanding ecosystem of 50+ active partners

Expanding ecosystem of 50+ active partners Amount restaked on Ethereum: $50M+

Amount restaked on Ethereum: $50M+ Amount restaked on BNB Chain: $450M+

Amount restaked on BNB Chain: $450M+ 10k+ Active Users consistently interacting with YieldNest products

10k+ Active Users consistently interacting with YieldNest products

Audits & Security

Security stays at the forefront of YieldNest. Over the past year, we’ve audited 12 Smart Contracts with reputable firms, including ChainSecurity, Zokyo, Hypernative, and Composable Security, ensuring advanced risk assessment and solid protocol reliability. In addition, YieldNest has an active bug bounty program via Immunefi, offering continuous incentives to identify and report potential vulnerabilities before they can be exploited.

Read more about our audits and security measures

Next Steps & Future Growth

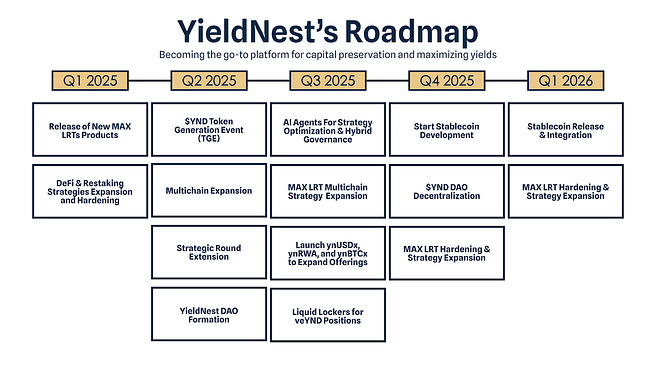

YieldNest is rapidly evolving into the go-to place for DeFi, ready to lead the DeFi Renaissance. Over the next year, we’re launching new MAX LRT products (ynUSDx, ynBTCx, ynRWAx), expanding across multiple chains, adding structured products, and integrating advanced AI-driven strategies. With our upcoming YND TGE marking a major milestone, we’ll progressively decentralize governance and introduce our native stablecoin to further enhance our ecosystem’s capital efficiency.

We are even thinking much further. YieldNest is evolving into a structured asset layer for on-chain finance. Where AI models optimize risk and strategy allocation. Restaking primitives enable dynamic, modular products. LRTs, RWAs, and DeFi strategies converge into a single programmable interface.

For more detailed information, you can check our Roadmap Article.

About YieldNest

YieldNest is a next-generation DeFi protocol that offers simple, high-yielding, risk-adjusted restaking and DeFi strategies. It merges DeFi’s best strategies into single, unified, high-powered assets with L1 settlement assurances. Powered & Secured by DeFAI.

Our mission is to simplify DeFi for all users by delivering secure, high-yield strategies through easy-to-use AI-powered products, robust security, and continuous innovation.

Join Us

The countdown to TGE has started, and while reading this, you are at an advantage. As you might have noticed, YieldNest has a fast-growing ecosystem backed by protocol revenue, DeFi Royalty, high-yield strategies, and a community-first vision. With YND at the center, everything from rewards to governance flows through you.

The flywheel is spinning. Don’t stand by and watch it happen.

Get YND. Stake it. Earn more.

![]() Website

Website

![]() App

App

![]() Discord

Discord

![]() Telegram

Telegram

![]() Twitter

Twitter

YieldNest FAQ

When is the YieldNest Token Generation Event (TGE)?

YieldNest’s TGE is scheduled for June 3, 2025.

How can I participate in YieldNest’s governance?

Stake your YND tokens to receive veYND, giving you voting power to influence protocol decisions such as fee distribution, integrations, and strategies. The other option is to use Liquid Lockers like Stake DAO, to stake your tokens into sdYND, and still be liquid.

How do I acquire veYND?

Stake your YND tokens through our governance portal on Aragon V2 and receive veYND NFTs.

Is there a lockup period for staking YND?

Yes. Exiting veYND to reclaim YND requires a 30-day queue and a minimum deposit of 42 YND for locking.

What can veYND holders vote on?

- Fee distribution

- New integrations and product launches

- SubDAO creation and strategic decisions

- Gauge adjustments for liquidity incentives

- Selection of supported AVSs and operators

- And more to come…

What is Aragon V2?

Aragon V2 is the infrastructure the YieldNest governance system is built on. By leveraging Aragon’s framework, we strengthen and refine DAO operations continuously.

How many ecosystem partners does YieldNest currently have?

YieldNest boasts an ecosystem of 50+ strategic partners, including major platforms like EigenLayer, Curve, Aragon, Base, Frax Finance, Convex, and many others.

How many MAX LRTs and strategies are available?

YieldNest currently offers 2 live MAX LRTs, with 2 more planned for release soon. Overall, there are 7 total LRTs and strategies available.

How many active users does YieldNest have?

YieldNest currently has over 10k+ active users participating across various strategies and integrations.

Have YieldNest smart contracts been audited?

Yes. YieldNest smart contracts have undergone rigorous security audits, with 12 smart contracts audited in the past year by reputable security firms such as ChainSecurity, Zokyo, Hypernative, and others.

What security measures does YieldNest employ?

YieldNest utilizes AI-driven continuous risk management provided by Hypernative and rigorous auditing through security leaders like Immunefi, Zokyo, and ChainSecurity.