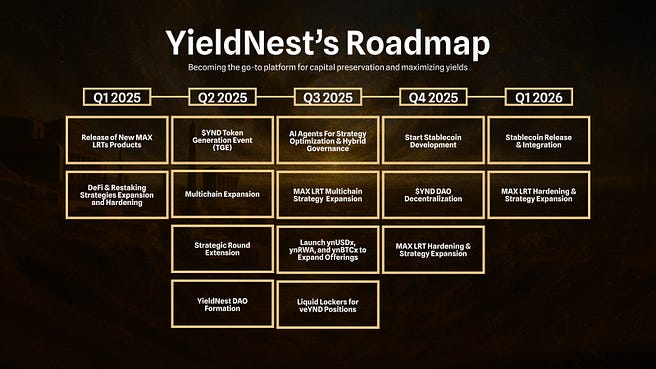

At YieldNest, we’ve always been clear about our goals and objectives. This is why we want to share with you a detailed update on our roadmap milestones. Here’s a list of what we’ve accomplished recently, what lies ahead for our protocol, and why we are set to lead the DeFi Renaissance.

Q1 2025 — Completed Milestones

Launch of ynBNBx MAX LRT

In the first quarter, we successfully launched the ynBNBx MAX LRT. This BNB-focused yield asset gives users exposure to optimized yields from BNB staking, restaking via Kernel, and DeFi integrations across BNB Chain, such as Thena, Pendle, and Euler. Since its launch, ynBNBx MAX LRT consistently generated attractive yields, providing users a secure option to leverage their BNB holdings.

ynETHx Official Launch

Alongside launching ynBNBx, we officially launched ynETHx and removed its cap of 1,000 ETH.

The launch came along with the opportunity for ynETH and ynLSDe holders to upgrade their assets into ynETHx, giving them access to our stake-and-forget solution to maximize yields.

Additionally, we enhanced the ynETHx yield-generation capabilities through integrations with notable DeFi protocols such as Curve, Convex, and Spectra.

Q2 2025 — Current Milestones

YieldNest TGE and YND Token Launch

One of the most significant milestones this quarter is our Token Generation Event (TGE). Scheduled for June 3, 2025, this event will officially introduce our governance token, YND, to the market. Immediately following the TGE, the YND Airdrop will take place, rewarding loyal Seed holders and early supporters. YND tokens represent governance rights, and holders who stake their tokens to veYND will have access to rewards and future protocol revenue. YND will also allow the use of Liquid Lockers (sdYND), more about that below.

Governance and Aragon Partnership

YieldNest’s governance leverages Aragon’s advanced infrastructure. Aragon, one of our strategic round participants, provides the framework that simplifies decentralized decision-making. YieldNest will introduce an intuitive governance interface, allowing token holders to submit proposals and vote clearly and efficiently.

Multichain Expansion

YieldNest integrated LayerZero, allowing seamless staking into our MAX LRTs across Ethereum, BNB Chain, and Base. Additionally, we’ve introduced our Swap page, powered by Enso, enabling easy asset swapping directly within our platform. Bridging functionality expanded significantly, now including networks like Scroll, Berachain, Optimism, Taiko, Hemi Network, Blast, Mantle, INK, Arbitrum, and Fraxtal, providing our users with comprehensive access to our MAX LRTs. Which we will be launching over time.

Strategic Round Extension

YieldNest’s strategic round extension welcomed key industry participants, including Aragon, A41, StakeDAO, Thena, Sky Wee, and Perspective. We have also allowed the YieldNest community to participate in the round and become a part of our journey, and we are glad that many of you did. The strategic round is still fully taking place and will be closing soon.

Q3 2025 — Upcoming Milestones

Development of Nest AI

In the upcoming quarter, YieldNest will accelerate Nest AI’s development. Nest AI, our AI agent, will turn into a yield optimization engine and will autonomously discover and refine strategies 24/7. By analyzing data in real-time, Nest AI will identify opportunities, mitigate risks, and ensure assets are deployed in the most profitable and secure strategies available across DeFi.

Hybrid Governance and SubDAO Structure

YieldNest plans to introduce a Hybrid Governance structure, implementing subDAOs within our ecosystem. SubDAOs will provide specialized governance for specific products or strategies, combining the efficiency of AI-driven management with active community oversight. This model will allow the YieldNest ecosystem to remain adaptable, efficient, and truly community-centric.

Multichain MAX LRTs

YieldNest will further enhance MAX LRT capabilities by adopting multichain strategies. MAX LRTs will dynamically optimize asset allocation across multiple networks based on yield potential and risk assessment, evolving YieldNest’s products into even more sophisticated, risk-managed yield-bearing assets.

Expansion of MAX LRT Offerings

We plan to expand our MAX LRTs lineup significantly. We’ll launch ynUSDx, a stablecoin-focused MAX LRT providing stable, attractive yields, and ynBTCx, a Bitcoin MAX LRT, which will provide BTC holders a compelling way to earn yields without compromising security. They will be integrated with our advanced AI-driven strategies. With ynUSDx and ynBTCx, we’ll also introduce various DeFi opportunities for holders to boost their earnings even more. Also, we are actively working on ynRWax, more about that below.

ynRWAx — Dipping into Real-World Assets

A product in the works that deserves its highlight is ynRWAx. A MAX LRT diversified across various Real World Assets (RWAs) and projects to provide the highest risk-adjusted yields. It will leverage RWAs, like real estate and others, placing them fully on-chain and allowing users to earn stable returns linked to tangible assets.

Introduction of Liquid Lockers

YieldNest will introduce Liquid Lockers for YND. Liquid Lockers enable YND token holders to delegate tokens to a third party, gaining enhanced yields without directly managing governance positions. This simplified approach offers users attractive benefits with minimal complexity. Launching with Stake DAO, additional partnerships with platforms like Convex will follow.

Q4 2025 — Future Milestones

Development of YieldNest’s Stablecoin

YieldNest plans to develop its own native stablecoin. A stablecoin will provide significant advantages within our ecosystem, facilitating seamless trading, stable yields, and improved liquidity. Additionally, it will expand YieldNest’s capacity to manage yield strategies with even greater efficiency.

YND DAO Decentralization

We aim for complete decentralization of the DAO in Q4. The YieldNest DAO will function independently, with AI governance tools assisting decision-making and automation. Decentralization ensures YieldNest stays community-driven, providing YND holders with all the influence over decisions related to protocol development, integrations, and overall strategy.

Q1 2026 — New Year, New Milestones

Launch of YieldNest’s Stablecoin

We plan to launch our stablecoin and unlock its potential through diverse DeFi activities bringing more liquidity to the protocol, enhancing capital efficiency, and strengthening our ecosystem. Most importantly, it will provide users with new yield opportunities and a unique way to leverage their YieldNest assets as we expand DeFi together.

Expansion and Improving MAX LRTs

MAX LRTs are comprised of complex strategies, and our mission is to optimize and enhance them to become the ultimate DeFi assets. Our plans include further improving their infrastructure, finalizing security refinements, and expanding our MAX LRT product suite.

YieldNest’s Future Vision

YieldNest is going beyond! We are utilizing restaking primitives to enable dynamic, modular products. Another step to our evolution into a structured asset layer for on-chain finance, where AI optimizes risk and strategy allocation, and where LRTs, RWAs, and DeFi strategies converge into a single programmable interface.

With strong partnerships, innovative products, and governance shaped by our community, YieldNest is ready to lead the DeFi Renaissance and reward everyone involved.

Make sure you check our docs for more information and feel free to participate via our governance forum. Or check other external research by Llama Risk, Shoal Research, or Alea Research.

Stick around, because we’re just getting started.

Are you ready for our TGE?

Stay updated via our official socials!