Proposal to Add sdYND/WETH Pool to Uniswap

Summary

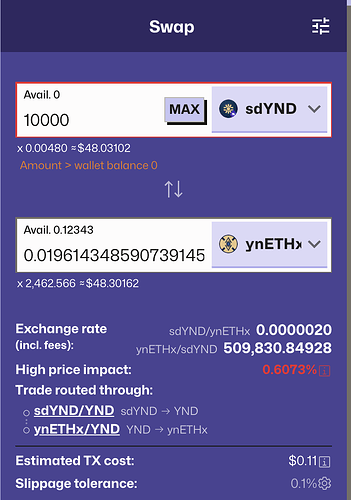

This proposal seeks to deploy a Uniswap V3 sdYND/WETH liquidity pool to address the liquidity constraints of the existing sdYND/YND pool on Curve Finance. The Uniswap pool will enable arbitrage opportunities, stabilize price parity between sdYND and YND, and provide additional liquidity provider (LP) opportunities, further insulating the YieldNest ecosystem from potential liquidity depletion.

Problem

The current sdYND/YND pool on Curve Finance is the only mechanism for exiting sdYND back to YND. This creates a structural issue: If demand for YND decreases or multiple entities unwind their sdYND stakes, the pool risks rapid depletion of YND. Without an alternative liquidity venue, this could lead to significant price disparities and liquidity shortages between both tokens, threatening the stability of the sdYND ecosystem.

Proposed Solution

Deploy a Uniswap sdYND/WETH pool seeded with full-range price liquidity. This pool will:

-

Allow arbitrageurs to sell sdYND directly for WETH, ensuring price parity between sdYND and YND by absorbing disparities in the Curve pool.

-

Provide a secondary exit path for sdYND holders, reducing dependency on the Curve pool.

-

Attract public LPs and arbitrageurs, enhancing liquidity and market efficiency.

Benefits

-

Ecosystem Stability: The Uniswap pool mitigates the risk of YND depletion in the Curve pool, ensuring smoother exits for sdYND holders.

-

Arbitrage Opportunities: Arbitrageurs can profit by maintaining sdYND/YND price parity across Curve and Uniswap, stabilizing the ecosystem.

-

LP Opportunities: The pool offers a new venue for LPs to participate, increasing liquidity depth.

-

Price Volatility Absorption: WETH pairing enables broader market exposure, reducing sdYND price volatility during unwind events.

Strategy

-

Cost Neutral Deployment: The pool will be seeded with full-range liquidity to minimize initial costs and encourage public participation.

-

Public Integration: Full-range liquidity ensures accessibility for arbitrageurs and LPs, fostering organic market activity.

-

No Additional Incentives Required: The pools design leverages market forces (arbitrage and LP participation) to maintain liquidity without external subsidies.

Next Steps

-

Community discussion and feedback on this proposal.

-

Vote to approve pool creation and liquidity seeding.

-

Deployment and monitoring of pool performance.

Conclusion

The creation of a Uniswap sdYND/WETH pool addresses a critical liquidity risk in the sdYND ecosystem. By enabling arbitrage, attracting LPs, and stabilizing prices, this solution strengthens YieldNests resilience and fosters a more robust market environment.