Pick a Strategy Name:

Perp DEX LP Vaults Aggregator

Title: ynUSDx / Perp DEX LP Vaults Aggregator

1. Select Your MAX LRT Category:

- ynETH MAX (ynETHx): Ethereum-based strategies

- ynBTC MAX (ynBTCx): Bitcoin-focused strategies

- ynUSD MAX (ynUSDx): Stablecoin-based strategies

- ynBNB MAX (ynBNBx): Innovative BNB strategies

Selected Category: ynUSD MAX (ynUSDx)

Strategy Description:

This strategy bridges and deposits an underlying asset to various perpetual exchanges’ canonical LP vaults, such as Hyperliquid’s HLP, hJLP by Gauntlet, and many others, such as Vest Exchange, Paradex, and Lighter. These vaults are all run by the exchanges themselves or teams closely working with them. Since these are enshrined by exchanges, they often benefit from better execution, which results in competitive yield. By depositing into these vaults, we can consistently benefit from around 20%+ APY.

Protocol Risks:

- Smart Contract Risks: Bridge risks.

- Market Risks: There is a trust assumption on each of the exchanges, and a potential attack vector from price manipulation. However, this risk may not be critical and will soon be recovered if the team behind the exchange is competitive enough.

- Operational Risks: Since inter-chain operation cannot be forced by a smart contract, the operator has to manually bridge the assets between the exchanges and the ETH L1. Moreover, some vaults apply a buffer for withdrawal, so while maintaining a buffer on our strategy contract, that should be considered too.

Protocol’s Liquidity History:

- Current liquidity depth and health status.

- Historical performance and stability during stress scenarios.

- Note any past liquidity disruptions or challenges.

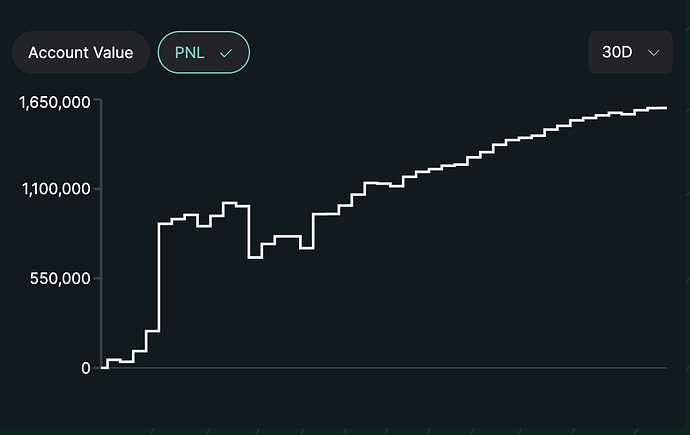

While many of the smaller exchanges lack a track record, we can predict that many of these often yield a juicy APY, with potential collapses but recover fast, too. Many of these vaults’ PnL curves resemble those of market makers, such as the following:

Redemption Flows:

- Detailed Flow:

-

- User requests for redemption, and redemption is instant as long as the requested amount is less than or equal to the idle funds.

-

- The operator regularly transfers funds between the original vault and exchanges, and maintains the target ratio of idle funds, for instance, 10%.

- Potential Issues: If the requested amount is greater than available funds, the user should wait or only partially redeem it.

Best-case Scenario: User experiences no problem and later operator rebalances the weights across the exchanges and L1 vault.

Worst-Case Scenario: One of the exchange vaults may experience a temporary loss, and users may request redemption while the share-to-asset ratio at the L1 vault is not updated yet. In this scenario, the rest bear the loss of the withdrawing users. To prevent or mitigate it, the withdrawal cap should be set conservatively, and the operator must frequently update the share-to-asset ratio.

Conclusion - Why Add This Strategy:

- Explain clearly why this strategy adds value.

- Highlight unique advantages and long-term benefits.

- Describe how it aligns with YieldNest’s broader objectives.

Being on the side of exchange is one of the most profitable strategies. Exchanges often share the trading fee and liquidation fee with these vaults. As a result, these vaults yield a competitive profit regardless of the market, while they even more benefit from high volatility and bull market seasons. Also, this strategy does not require any off-chain infrastructure except monitoring and transferring assets between the chains. If this goes big, many smaller exchanges would reach first while promising a specialized term for us, too. In that case, not only do we receive yields from MMing, but we may also receive potential airdrops of tokens from these exchanges, too.

Submitted by: wycfwycf

Date: 2025/04/21