**This protocol is new with low liquidity. As well, Burve Fi’s LP money market rehypothecation strategy isn’t available until July 2025

Burve Multi-Swap Stablecoin Amplifier

Title: ynUSD MAX / Burve Multi-Swap Stablecoin Amplifier

Title: ynUSD MAX / Burve Multi-Swap Stablecoin Amplifier

1. MAX LRT Category:

- ynUSD MAX (ynUSDx): Stablecoin-based strategies

Strategy Description:

This strategy leverages Burve’s Rehypothecating Stable Multi-Swap AMM on Berachain, enabling liquidity providers to supply up to 16 stablecoins in a single pool to increase capital efficiency (up to 15×). This strategy will use a subset LP consisting of USDC, USDT, DAI, and frxUSD (USDT and frxUSD currently not offered) and would give 3x more yield.* By combining dynamic concentrated liquidity, rehypothecation to money markets, and optional BGT governance token farming, this strategy targets a blended APY of 10–15%.

Protocol Risks:

-

Smart Contract Risks:

-

Vulnerabilities in AMM smart contracts, rehypothecation mechanisms, or BGT auto-farming scripts.

-

Historical context: To my knowledge Burve’s Stable Multi-Swap AMM, which offers “dynamic concentrated yields) is a novel idea inspired by both Curve’s stable equation and Uniswap V3 concentrated liquidity to further enhance capital efficiency.

-

-

Market Risks:

-

Stablecoin depegs or liquidity crunches (unlikely once protocol matures).

-

Increased IL from aggressive concentration strategies.

-

BGT token price volatility affecting reward valuations.

-

-

Operational Risks:

-

Governance misconfigurations (e.g., wrong concentration levels, subset settings).

-

Delayed oracle responses in depeg detection.

-

Dependency on money market health for rehypothecation yields.

-

Protocol’s Liquidity History:

-

Current Liquidity Depth: Early-stage but growing; designed to scale with up to 16-token pools. This protocol is brand new. Website reports $445,445 in TVL but upon checking the pool is empty: Pool

-

Historical Performance: Strong theoretical capital efficiency; real-world stress performance yet to be proven.

-

Past Challenges: No disruptions reported yet for the new protocol, but must monitor governance management as TVL scales

Redemption Flows:

-

Detailed Flow:

-

Withdrawal from Burve USD Omni pool.

-

System pulls liquidity from AMM, rehypothecation vaults, and/or money markets.

-

Receives selected stablecoin(s) single-sided.

-

Liquidate stablecoins and BGT rewards for ynUSDx

-

-

Potential Issues:

-

Temporary withdrawal delays if funds are locked in money markets during peak demand.

-

Oracle-triggered trade halts may block redemptions from affected tokens.

-

Best-case Scenario:

- Smooth, near-instant withdrawal with no slippage, automatically sourcing funds from AMM + rehypothecation layer.

Worst-Case Scenario:

- Depeg event causes oracle halt; subset of liquidity frozen; partial redemptions or time delays until pools stabilize.

*Multi-swap pool explanation:

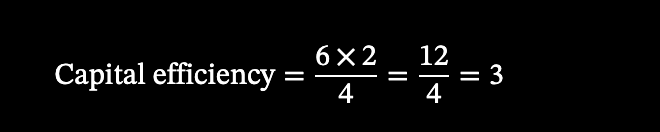

Using USDT, USDC, DAI, and FrxUSD as an example, say you want to earn yield from LP’ing them. Using normal AMMs, you’d provide liquidity to each of the USDT-USDC, USDT-DAI, USDT-FrxUSD, USDC-DAI, USDC-FrxUSD, and DAI-FrxUSD pools. If they all average 5% yield, you’d earn 5% yield overall. Notice that your USDC, for example, is split across its three pairs: USDT-USDC, USDC-DAI, and USDC-FrxUSD, earning 5% on each portion.

With a multi-swap pool, you provide liquidity to just one pool with one single-sided deposit containing USDT, USDC, DAI, and FrxUSD. That deposit can use any of the tokens for any swap. This means the entirety of your deposited USDC is used for the USDT-USDC pair, the USDC-DAI pair, and the USDC-FrxUSD pair—all at the same time. In comparison to depositing individually for each pair, you now have triple the capital efficiency (See calculation below), which causes you to earn triple the yield. All of your USDC is earning 5% from USDT-USDC, 5% from USDC-DAI, and 5% from USDC-FrxUSD; all of your USDT is earning 5% from its three pairs; and so on for DAI and FrxUSD. This gives you an average yield of 15% across all your tokens, compared to just 5% with individual AMM pools.

Captial Efficiency calculation:

Conclusion - Why Add This Strategy:

Because this is not a stress-tested protocol and strategy it is not ready to be used within the YieldNest ecosystem at this time, rather it may add a cutting-edge, capital-efficient stablecoin yield approach to the ynUSD MAX lineup in the future. It unlocks multi-pool yield amplification, auto-compounded governance rewards, and deep flexibility with subset LPing and fixed-yield lockups. By integrating Burve, YieldNest broadens its exposure to next-gen AMM architectures and rehypothecating designs, aligning with its mission to deliver maximized, diversified, and risk-adjusted yields to users. Once other stable coins mature, additional stablecoins may be added to the multi-coin pools for more yield!

Submitted by: Msojumper

Date: May 2, 2025