Bear Market ynETHx Yield Harvest w/ *Optional Auto-Swap Hedge

Bear Market ynETHx Yield Harvest w/ *Optional Auto-Swap Hedge

Title:

ynUSD MAX / Bear Market Yield Harvest w/ Optional Auto-Swap Hedge

Category:

![]() ynUSD MAX (ynUSDx) – Stablecoin-based strategies

ynUSD MAX (ynUSDx) – Stablecoin-based strategies

Strategy Description:

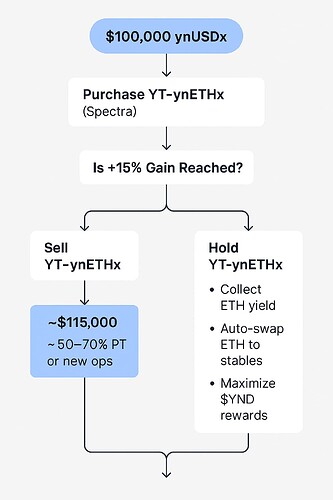

This strategy deploys ynUSDx to purchase YT-ynETHx on Spectra Finance, giving users exposure to ETH staking and restaking yield without taking on direct ETH price risk.

A dedicated arbitrage bot monitors the position and executes a sell if a +15% profit threshold is reached. If this threshold is not met, the strategy continues passively accruing yield via the YT-ynETHx position.

To further protect the value of accrued ETH rewards, an optional auto-swap hedge can be activated — periodically converting ETH into ynUSDx. This balances high-yield upside with USD-denominated downside protection, offering users a modular, risk-adjusted yield flow.

The strategy also amplifies $YND rewards by maintaining eligibility for the 6x seed multiplier and ensures more efficient YT pricing, benefiting the broader YieldNest ecosystem by reducing the risk of mispriced YT purchases.

Target Users:

-

The inclusion of YT-ynETHx, $YND 6x seed multiplier, and opportunistic arbitrage will appeal to those who desire capital efficiency and compounding.

-

Risk averse DeFi participants who prioritize stablecoin-denominated portfolios and are uncomfortable holding volatile assets like ETH directly in a bear market but would prefer yield in ETH.

Example Flow:

Protocol Risks:

-

Smart Contract Risks:

Involves interaction with Spectra Finance smart contracts (YT/PT), automation bots, and swap platforms. Risks include contract vulnerabilities, oracle inaccuracies, or integration failures. -

Market Risks:

ETH price volatility affects the USD value of ETH yield, and YT-ynETHx markets may experience discounts or illiquidity during high volatility. Arbitrage conditions may also vanish during stressed markets. -

Operational Risks:

Dependency on bots (arbitrage or auto-swap) introduces execution risk from misconfigurations, automation failures, or changes in protocol governance (Spectra, DEXes, or automation services).

Protocol’s Liquidity History:

-

Current Liquidity:

Spectra’s YT/PT pairs have shown growing liquidity and deepening integration with Ethereum mainnet and restaking protocols. -

Historical Performance:

Stable during typical volatility; some spread widening during high-stress scenarios (e.g. LST market corrections). -

Liquidity Challenges:

Occasional thin order books, particularly during market shocks or protocol upgrades; users should monitor redemption timing and slippage risk.

Redemption Flows:

-

Detailed Flow:

-

Purchase YT-ynETHx on Spectra with ynUSDx.

-

Hold position while bot monitors for +15% arbitrage profit.

-

If threshold met → sell YT for ynETHx OR split proceeds into PT and new YT positions (Just a thought but probably too complicated).

-

If threshold not met → accrue ynETHx yield (w/ optional auto-swap into ynUSDx.)

-

At YT expiration → receive final ynETHx yield OR swap to unUSDx OR reinvest.

-

-

Potential Issues:

Delays in arbitrage execution, failed auto-swap triggers, gas spikes, or drying liquidity in YT/PT pools. -

Best-Case Scenario:

Arbitrage triggered and realized at +15%, yield is converted smoothly to stables, portfolio compounded into PTs or YTs, and $YND rewards are maximized under full multiplier eligibility. -

Worst-Case Scenario:

No arbitrage exit, ETH price drops significantly reducing yield value, auto-swap fails or executes inefficiently, requiring manual intervention.

Conclusion – Why Add This Strategy:

This strategy adds a unique stablecoin-based, market-resilient solution for those who want to stack ETH without direct price exposure. It allows users to participate in ETH restaking yield without taking principal ETH price risk, while adding layers of automation to lock in USD gains (optional) and opportunistic arbitrage.

Key Benefits:

Key Benefits:

- Expands strategic options within ynUSD MAX vault

- Highlights modular design via YT, PT, arbitrage, and automation

- Boosts $YND reward potential through multiplier maximization

- Attracts conservative and strategic DeFi users seeking yield without exposure to ETH price volatility

Submitted by: MsoJumper

Date: May 11, 2025